Business

NSDL PAN Card | Card Status | Application | Correction

NSDL PAN Card: NSDL stands for National Securities Depository Limited, which is an Indian central securities depository based in Mumbai. It was established in November 1996. It is the first electronic securities depository in India with the National Coverage based on the suggestion by the National Institution responsible for the economic development of India. You can get almost all the services based on the financial aspects through the NSDL. You can apply for the PAN, TDS and other tax-related documents through the NSDL.

NSDL PAN Card

PAN Card Status

A PAN (Permanent Account Number) is one of the most significant documents in India, and all the eligible taxpayers are expected to have the PAN Card. PAN Card has the simplified and streamlined taxation system for the government, It provides sufficient information and bringing about the transparency in the financial transactions. It is mandatory for all the Indian Citizens. It takes around 15 working days for an individual to receive their PAN after applying it. The government of India makes it easy for an applicant to track the status of their application So that people can quickly know the current happening of their PAN application. You can track the status of your PAN application, with the 15 digit acknowledgment number given by the government of India. PAN card applicatoin status can be checked using various methods, the methods to check the status of the PAN Card is given below.

SMS Facility: In this method the applicant can track their application status through their phone, using the specialized SMS service. You can do this by sending an SMS with a format of “NSDLPAN <15 digit acknowledgment number>” to 57575. After sending an SMS, you can receive the SMS regarding the current status of your PAN application.

PAN Card Status Via SMS

Telephone Call: You can also know the status of your PAN application through the phone call to the TIN call center So that you can get the update regarding the application status of your PAN card by calling 020-27218080 and you will be asked to provide your 15 digit application acknowledgment number to get the status.

PAN Card Status Via Telephone Call

Online Tracking: This is one of the simple and easy methods to check the application status of your PAN Card instantly. You can do this by visiting the official website of TIN-NSDL (https://tin.tin.nsdl.com/pantan/StatusTrack.html) and provide your acknowledgment number to track the status of your PAN Card instantly.

PAN Card Status Via Online

PAN Card Application

PAN Card is mandatory for all Indian Citizens, and You can get the PAN Card Application form using two ways one is Online, and another one is through Offline. The PAN Card application form can be divided into two types From49A for Residential Indians and Form 49AA for the Non-Residential Indians

PAN Card Application Form 49A

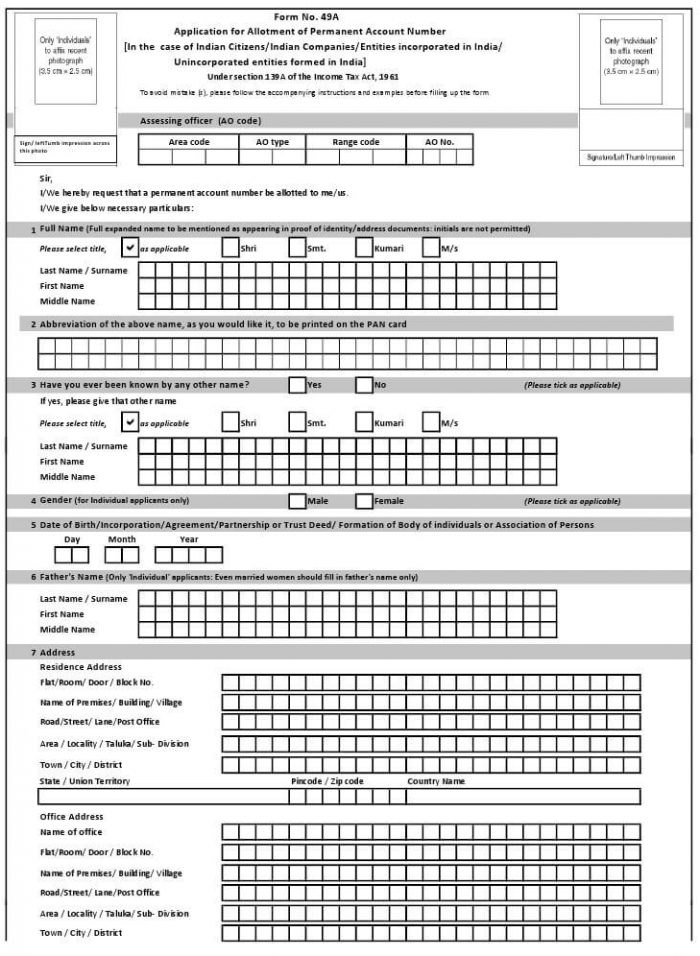

Form 49A is the PAN Card Application from which is used by the citizens of India and also by the companies in India and entities incorporated in India or unincorporated entities formed in India. You can get the From 49A through Online by visiting the official website of NSDL and fill your details right there. You can also get them from offline by visiting the downloading section of the NSDL website. After downloading the form fill the form with required details and append your residential proofs and then send it to the local UTIITSL center.

PAN Card Application Form 49A

How to fill PAN Card Application Form 49A?

PAN Card Application Form 49AA

PAN Card Application Form 49AA is used for the individuals, who are not the Citizens of India, Entities incorporated outside India or Unincorporated entities formed outside India. Form 49AA is available online by visiting the official website of NSDL, and there you can find the form and fit it online. You can also get the form offline by visiting the official website of the NSDL and download the form and then fill it up with required details and attach your proofs and send it to the nearest UTIITSL center.

PAN Card Application Form 49AA

How to fill PAN Card Application Form 49AA?

PAN Card Apply Online

PAN Card can be applied through online, and this saves a lot of time. You can apply for the PAN Card easily through online. You can even make the update request of your PAN Card through online, and this can be done by just visiting the official website of NSDL ( https://tin.tin.nsdl.com/pan/index.html ). Follow the steps below to apply for a PAN Card through Online.

Step 1: Visit the NSDL website https://www.onlineservices.nsdl.com/paam/endUserRegisterContact.html

Step 2: Then just select the form type you wish to apply for Form 49A for Residential Indians and Form 49AA for Non-Residential Indians.

Step 3: Now you can fill up the form by providing the required details

Step 4: After entering all the required details you can move on to the payment section, just make the payment for your PAN Card through net banking, debit/credit cards or demand drafts.

Step 5: After completing the payment process upload the required documents for complete the Online registration of the PAN Card.

PAN Card Correction Form

PAN Card is an essential document for Indian Financial context So that the data available in the PAN Card must be correct and accurate. In case if there are any discrepancies between your actual data and the PAN Card, Government of India has provided you with an option to make the necessary changes in your PAN Card. You can correct the details of your existing PAN card through online or offline. For correcting it through online visit the official website of NSDL and then navigate to the PAN Card Correction form and then fill up the form with the correct details and then submit the form for processing. You can also check the status of your application by merely track it by the given acknowledgment number through online.

How to fill PAN Card Correction Form?

PAN Card Correction Form

Pan Card Queries

How to check Pan Card Status by Name, DOB, and Pan Number

UTI PAN Card Status, Application, Apply Online and Correction

How to Link Aadhaar Card To PAN Card

Thanks For Reading.