GST

GST Invoice Format and Rules | All About Invoicing Under GST

Each and every seller who sell their products or services to the customer must issue an Invoice copy to the customers. It is mandatory that everyone should be aware of the new GST Invoice as it comes with quite a number of changes in the current regime. Here in this article, the GST invoice and how to create it, things to be included, new format are discussed in detail.

The GST is going to change the way the country is now complying with taxation. It is going to unite all the States and Union Territories under one roof for a better and wise tax reporting structure. In order to achieve this, GST requires a hassle free invoice based reporting system of the process flow. Thus all the important information about the goods and services are recorded and maintained until the last stage.

Read also: Save My Tax Launches GST Compliance Software for Tax Practitioner’s, Traders & MSMEs

The current tax system allows the premises to prepare own invoice because of the different service tax, central excise, and VAT. But the needs and procedures of such invoice vary from state to state. So GST imposes the uniform invoice for registered premises all over the country. As invoices become the only factor for the whole transaction of the goods, having a single format will have a smooth flow throughout the process. The logistics and the supply chain will have a clear approach towards maintaining, uploading and returning the services or goods.

Invoicing Under GST

The invoices issued hereafter by all business should follow the new GST Invoice format containing the following:

- Name, address and GSTIN of the supplier

- A consecutive serial number, not more than sixteen characters, in one or multiple series, containing alphabets or numerals or special characters hyphen or dash and slash symbolised as “-” and “/” respectively, and any combination thereof, unique for a financial year

- Date of issue of Invoice

- Name, address and GSTIN or UIN, if registered, of the recipient

- Name and address of the recipient and the address of delivery, along with the name of State and its code, if such recipient is un-registered and where the value of taxable supply is fifty thousand rupees or more

- HSN Code in case of goods

- Accounting Code in case of services

- Description of goods and services

- Quantity in case of goods and unit or Unique Quantity Code thereof

- Total value of supply of goods or services or both

- Taxable value of supply of goods or services or both taking into account discount or abatement, if any

- Rate of tax (central tax, State tax, integrated tax, Union Territory tax or cess)

- Amount of tax charged in respect of taxable goods or services (central tax, State tax, integrated tax, Union Territory tax or cess)

- Place of supply along with the name of State, in case of a supply in the course of inter-State trade or commerce

- Address of delivery where the same is different from the place of supply

- Whether the tax is payable on reverse charge basis and

- Signature or digital signature of the supplier or his authorised representative

In addition to the above details, an invoice of an export good or service shall include the following:

- A mandatory statement mentioning the specific words – “SUPPLY MEANT FOR EXPORT ON PAYMENT OF IGST” or “SUPPLY MEANT FOR EXPORT UNDER BOND WITHOUT PAYMENT OF IGST”

- Country of destination

- Delivery address

- The Number and date of application of form for removal, i.e. Form ARE-1

Also, when an Input Service Distributor issues the invoice, then “Amount of credit distributed” shall also be added to the invoice instead of the rate and value of the goods or services.

In case you are a Goods Transport Agency, you are an important link in the supply chain and has to include the following in your invoice:

- Name and address of the consignor and the consignee

- Registered Vehicle number

- Gross weight of the consignment

- Place of Origin

- Destination

- GSTIN of the person liable to pay tax

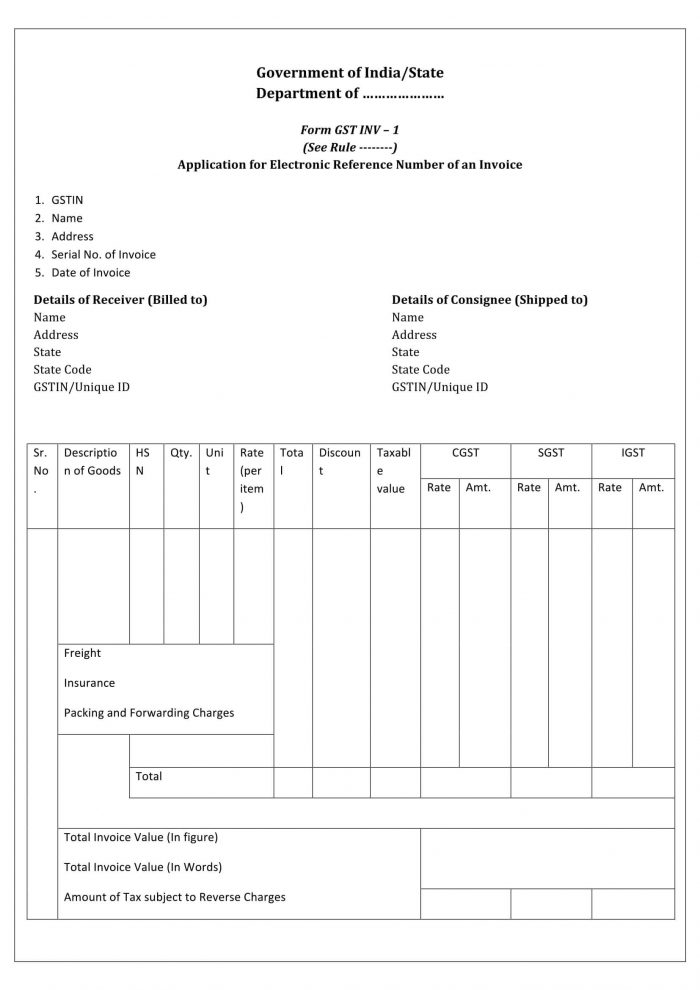

GST Invoice Format

The government has clearly notified the invoicing procedures along with the template of the GST Invoice (GST INV-01) including all the details such as supplier’s details, taxation details, etc. The invoice format of the GST is given below.

GST Invoice Format

GST Invoice Format

Copies of GST Invoice

The GST requires the businesses to prepare triplicate of invoices for the supply of goods as given below:

- The original copy being marked as ORIGINAL FOR RECIPIENT

- The duplicate copy being marked as DUPLICATE FOR TRANSPORTER

The transporter need not carry the invoice if the supplier has provided the Invoice Reference Number.

How to obtain “Invoice Reference Number”?

The supplier can obtain an Invoice reference number from the common portal (GSTN) by uploading the tax invoice issued by the supplier. The invoice reference number will be valid only for 30 days from the date of uploading.

- The triplicate copy being marked as TRIPLICATE FOR SUPPLIER

The GST requires the businesses to prepare a duplicate of invoices for the supply of services as given below:

- The original copy being marked as ORIGINAL FOR RECIPIENT

- Tthe duplicate copy being marked as DUPLICATE FOR SUPPLIER

Note: Once the invoice is issued, the serial number of the invoices issued during a tax period should be uploaded electronically through the GST Common Portal in Form GSTR-1.

Apart from the tax invoice, other important documents include Supplementary Invoice, Revised Invoice, Debit or Credit Notes, and Bill of Supply, are discussed in detail below.

Time Limit for Issuing Invoice

The invoices must be issued within a time period of thirty days from the date of supply of goods or services. It is to ensure timely filing of the records to both the businesses and the taxation department to minimise the chaos.

Bill of Supply

The tax invoice is issued in order to charge the tax and avail the credit. Under certain cases in GST, the supplier cannot charge any tax on the customer and thus tax invoice cannot be issued. Instead, GST has another document called Bill of Supply to be issued.

Circumstances where a registered supplier needs to issue the bill of supply:

- Providing supply of exempted goods or services

- Supplier is paying tax under composition scheme

Supplementary Invoice / Debit Note

During an upward revision of prices in the goods and services provided earlier, it complies with the GST. Thus the supplier has to issue a supplementary invoice to the recipient. That supplementary invoice must be raised within 30 days from the date of price revision.

Credit Note

Same as the debit note issued during an upward revision in price, a credit note is to be issued during a downward revision. GST should be levied on the previous transaction. These credit notes has to be issued within 30th September of the following financial year or before filing the annual return of GST, whichever comes first.

The contents of the documents are same as that of the tax invoice and the only difference is that the nature of the invoice must be mentioned in Bold on the top of the invoice as “SUPPLEMENTARY INVOICE,” “DEBIT NOTE” for example.

The GST Council currently prescribes to preserve the above document for 6 years. Thus it needs a firm IT system to maintain the huge database for the desired time.

Click here for more GST News and Updates

GST Invoice – Key Points to Remember

The below are some important points relating to invoices to be remembered:

- The concept of the retail invoice has gone. Under GST only TAX INVOICES are to be issued.

- The Invoice needs to be issued at the time of supply of goods. In the case of services, the invoices should be issued within 30days from the date of supply of service.

- Where the amount of invoice is less than Rs. 200 then no need to issue the invoice in case of B2C transactions. However, in respect of such supplies, the supplier shall issue a consolidated tax invoice for such supplies at the close of each day in respect of all such supplies.

- If the invoice amount is more than Rs. 50,000 and recipient is an unregistered person, then it is mandatory to mention the name, address, the state of the receiver on the invoice.

- In case of purchase of goods/supply from an unregistered person, a payment voucher along with a tax invoice (for self) needs to be issued.

- In case of supply of goods, the assessee has to prepare three copies of invoice one for purchaser, second fo the transporter and third for self.

- Person supplying services have to make two copies of invoice one for the service receiver and second for the self.

- In case of advance payment received, receipt voucher needs to be issued, and if no supply has been made against such advance, issue a refund voucher. If only a part of supply is made against it issue a credit note.

- A composite dealer needs to issue Bill of supply.

- Once the tax invoice has been uploaded on GSTN changes cannot be made by the assessee. In case of any changes to be done, then they should be made through debit and credit note. The information mentioned in tax invoice should be mentioned in debit or credit note to execute the changes.

To have a free flow of credit, it is easy to use a GST compliance software to help you maintain the book of records in the proper format. It is high time that you start preparing yourself and your business to get into GST and thus having a GST compliance software may ease your work.